House Rich, Cash Poor? Here’s How to Buy Your Next Home Without Selling First

It’s possible to sell your old home and buy a new one without facing qualification or timing challenges, and it’s important to become familiar with the differences between each alternative

Understanding Home Equity: A Valuable Asset for Homeowners

Home equity is more than just a number on a balance sheet; it’s a valuable asset that can be used to improve your financial well-being. Whether you’re looking to make home improvements, consolidate debt, or cover large expenses, tapping into your home equity can help you achieve your goals.

Contingent vs. Pending Properties: What’s the Difference?

If you’re eyeing a contingent or pending property, you may still have opportunities to make an offer or view the home. Understanding these distinctions can empower you to act swiftly and strategically in a competitive market.

How a Reverse Mortgage Can Help Fund Healthcare and Home Renovation Needs

And with over 11,000 people turning 65 each day, the demand for innovative retirement solutions is greater than ever. We strive to enhance your financial options during retirement, providing you with the resources to navigate your golden years with confidence.

Highly Anticipated FHA 203(k) Loan Updates Coming Soon

With higher allowable renovation amounts and extended timelines, the 203k loan program is becoming increasingly flexible and attractive for homebuyers looking to invest in fixer-uppers.

Everything You Need to Know About Closing Costs

Buying a home is an exciting journey, but over 50% of first-time homebuyers are caught off guard by closing

A Homeowner’s Guide to Using an Escrow Account for Your Property Taxes

Property tax escrow accounts are a significant component of homeownership, providing a structured way to manage your property tax payments. By understanding how these accounts work, you can navigate your mortgage with greater confidence and ease.

Rental Costs Are on the Rise: Why Owning a Home Is More Attractive Than Ever

In the face of rising rental costs, the shift towards homeownership is more pertinent than ever. By taking advantage of down payment assistance programs and understanding the true benefits of owning, you can start paving the way toward a more secure financial future.

10 Home Maintenance Projects to Complete This Fall

Taking a proactive approach to home maintenance not only enhances your comfort but also helps prevent costly repairs in the future.

Why Banks Use Escrow Accounts for Homeowner’s Insurance and How It Benefits You

Are you double-paying your homeowner’s insurance with an escrow account? What is the benefit of an

203(k) Loans: Your Solution for Renovation and Appraisal Challenges

Whether you’re facing renovation funding challenges or dealing with appraisal issues, a 203(k) loan may provide a flexible solution to help you achieve your home improvement goals.

Number of Homes for Sale Increases by 19.8%: How to Navigate the Recent Surge in Inventory

The housing market is experiencing a notable shift as inventory levels increased by 19.8% year-over-year.

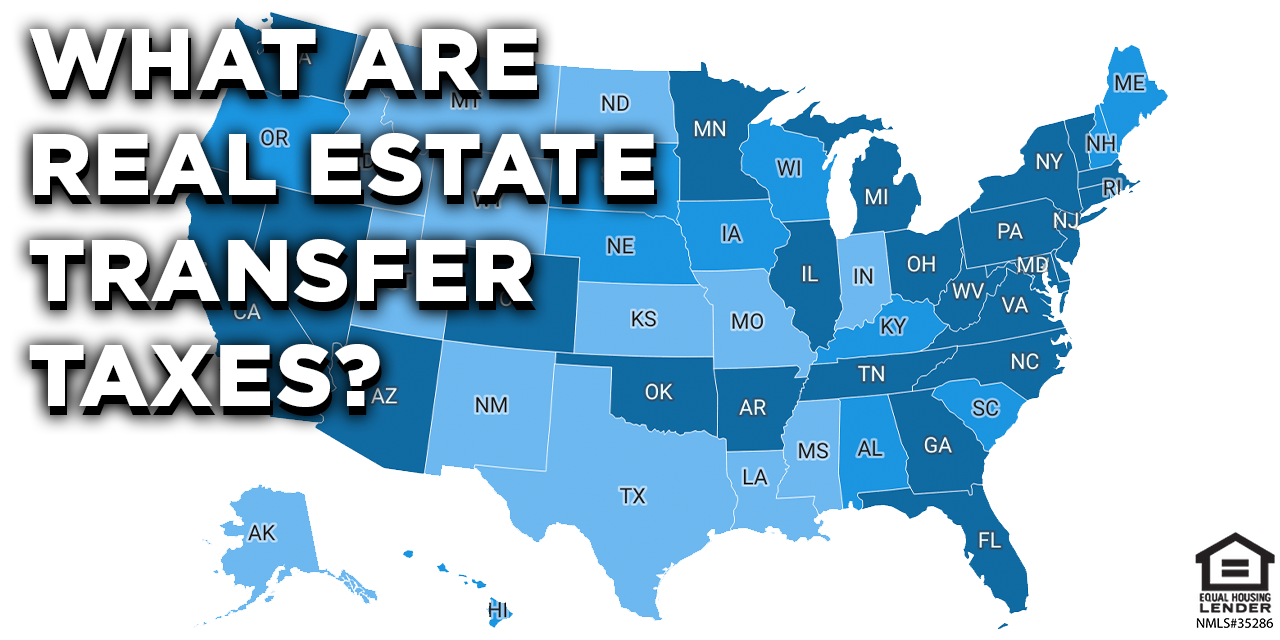

Real Estate Transfer Taxes: What to Consider When Selling Your Home

When it comes to selling a home, many homeowners are not aware of their state’s transfer tax,

Your Guide to Home Insurance: Strategies for Budgeting and Coverage Planning

The average annual cost of U.S. homeowners insurance is $2,511, or over $200 per month, according to Quadrant

The Future of Real Estate Commissions: Strategies for Paying Buyer’s Side Realtor Compensation

Prior to the NAR policy changes that are taking place in August 2024, sellers have historically covered